Everyone wants more money. Everyone wants less stress about money. Everyone should have a basic understanding of you can get your financial house in order. In this guide I’m sharing my personal finance knowledge so you can have a richer life. A life with less stress, a better overview and more money to spend (if you want). But you can also choose to have a shorter time before you can become financially independent.

Disclaimer: I am not a financial expert. Always consult a (certified) expert before making changes to your financial situation. This is just an example of how I do my personal finance.

Table of Contents

It all starts with an overview of your current finances

- Create a big Spreadsheet

- Run through ALL your income and expenses from the past year

- Write them down in the Spreadsheet

- Lookup the interest rates of your debts (credit card, car, house, other personal loans)

I’m in the process of creating an example Spreadsheet for you. In the meanwhile, keep reading and learning.

The budget is a means to an end. It gives you a great overview of your income and expenses. Especially your expenses. Only a few percent of people make a household budget. If less stick to it.

Creating an overview/budget is a big step in creating financial freedom

You have to put some effort into this. Like I said: go through ALL your incomes and expenses from the last year. Most of your expenses are fixed, but you can make the biggest gains but looking at the non fixed expenditures and making changes to them.

Before we budgeted on food, we spent almost $1200 a month on it. Now if you make a boatload of money, it doesn’t really matter. But I’d rather spend a bit less than a bit more. We actually had no clue how much we spent because:

- We paid for our food on 3 different debit cards. My private card, my girlfriend’s private card and our mutual card. So we had no idea.

- We didn’t keep track of our food expenses

- We didn’t have a budget

Right now, we’re working on getting our spending to about $750 a month. It’s a constant challenge for us. You have to keep track of what you’ve spent. You have to look at how long your month still is and what you can still spend. You have to purchasing lists. Etc. Etc. I’ll go into it a bit deeper later in this post.

Split your expenses in 3 parts

- Fixed

- Subscriptions

- Non fixed

Fixed expenses are hardest to lower. That’s why they are fixed. You can always live smaller and save on your rent that way, but that should only be done if you spend upwards of 60% – 70% on rent / mortgage. Most people spend between 25% and 50% of their household income on their rent / mortgage. If you spend upwards of 60% try to find a roommate. It’s an easy fix to lowering your percentage spent on your rent / mortgage.

In this subscription-based economy our spending on subscriptions has sky rocketed. You can have subscriptions for anything really. It’s pretty easy to spend 10% of your household income on subscriptions.

You non fixed income is the easiest to take control of. This consists of groceries, travel, electronics and clothing. There’s 1 exception to this category: medical bills. It’s not fixed but you also don’t want to save on medical bills.

The overview should be an eye-opener for you

Once you finish the overview you should immediately see where the big chunks of your monthly check goes to. What are the largest expenditures for you? Groceries and clothing? Groceries and travel?

Budgeting is different for everyone. If you really enjoy buying clothes, you wont hear me say not to do it. The most important thing you should ask yourself is: is this worth it to me? If you spend upwards of 10% of your income on clothes you should ask yourself if it’s worth it. If you’re spending more than there’s coming in, things will become different. It’s no longer a question of being worth it. It’s a question of: am I lowering my spending on clothes or on something else. You have to do something. Ramping up your credit card or personal debt to keep you in the spending mode is not a sustainable way to live. You have to change something.

You can have different goals of creating grip on your personal finance

- Get out of debt

- Retire early

- Save more (to spend on other things)

- Become financially independent

- Leave something for your children

- Etc

How to get out of debt?

If you’ve made the Excel and you have the overview, you can see in one glance if you’re left with some money at the end of the month/year of if you spend too much and are ramping up your credit card / personal debt.

Your first response to when you’re ramping up debt is to STOP ALL SPENDING. Go sit at home and think about what you’re doing. Don’t be a moron. Don’t keep your lavish lifestyle you can’t afford. Also don’t think that a credit card debt of $10,000, $50,000 or even $250,000 is insurmountable. It is. I’ll show you how

So. You decided to stop spending? Yes? GREAT! Now.. CUT YOUR CREDIT CARDS IN HALF. As in literally take the scissors and gut them to pieces. All of them. Grab your debit card and put it front and centre in your wallet.

Next up is: finding out which credit card to repay first.

There are 2 strategies to pay back your credit cards. The smartest way and the emotional best way.

The smartest way is the simplest. Write down all your credit card debts and their interest rates.

$20,000 @ 12% = $2,400 interest per year

$8,000 @ 10% = $ 800 interest per year

$17,000 @ 13.4% = $2278 interest per year

When you want to spend the least amount of money when paying back your credit cards, you should pay back the one with the highest interest rate.

If you want a bit more emotional support when you’re paying back your credit card debt, then you should pay back the smallest amount first. It will give you the quickest “feel good” boost and will keep you on the right track longer. If you’re a very (emotional) stable person. Choose the smartest strategy.

If you’re a strong person who has a lot of mental resilience you could use your other debt options as an advantage. I must caution you here… If you have a lot of debt, that’s usually a signal that you think you are resilient but you’re not. Only in rare cases (with large medical bills for example) do you ramp up a lot of debt.

If you do have other debts you might have some more room to move. In the above example you want to pay off the 13,4% interest debt first. If you have a personal finance option that has some room left, use the room your have there to pay off some credit card debt. Usually a personal loan has an interest rate well below 10%. Always check first though!

When I had my student loan I had an interest rate of 7%. That was over 10 years ago. So I’m sure with the current low(er) interest rate you should have or can find a loan where the interest rate is (a lot) lower then your credit card rate.

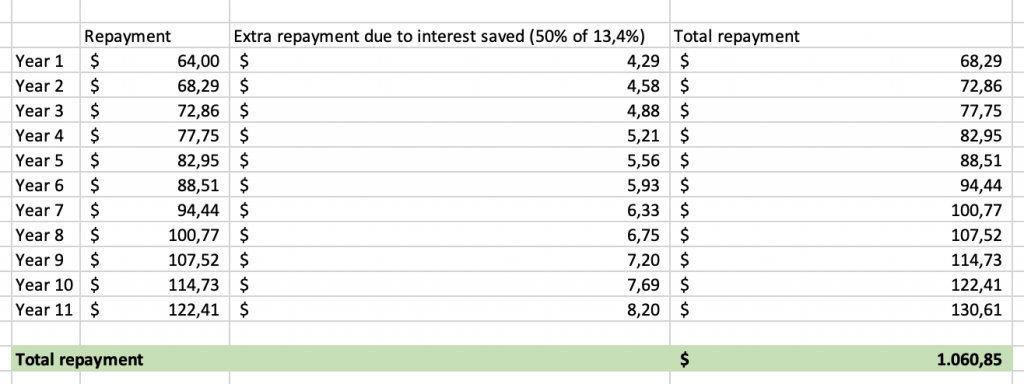

If you only pay back $1000 of credit card debt with a personal loan @ 7%, you save 13.4% – 7% = 6.4% * 1000 = $64 a year. That’s a little over $5 a month you can use to repay the debt even quicker. Just those $64 compounds to a lot of money over a 10 year period.

Those 64 dollars, if you paid back that amount plus the amount you save on interest would net you $1060 in 11 years. For doing nothing except moving a bit of debt. That’s actually what big companies do a lot. It’s called refinancing. They’re always on the lookout to repay their current debt for debt with lower interest rates. You will have saved more than the initial $1000 you diverted from another loan. That’s the power of compounded interest.

Consider what you can do if you have more room at different loans. Make a list of all of them and see what’s the best route to pay the least amount of interest and save the most through the compounding of interest.

There’s an even easier way to repay your credit card debt: sell stuff

You should treat credit card debt (or any interest carrying debt really) as an emergency. As a life threatening infection that if left untreated will kill you. If you threat it like that, things become real serious real quick.

Have a second car? A motorcycle you don’t use? An attic full of stuff you don’t use? Craigslist (or your local version) is your friend.

If you have a 2nd car or motorcycle or anything that also costs a monthly sum, you’ll kill 2 birds with one stone. I don’t know how this works in the US, but here in the Netherlands owning a car is expensive. I own 2 cars. One is an asset (I make money with it) the other one is a hobby. For my “asset car” I pay $2400 a year in fixed costs. That’s a lot of money. Compound that for 11 years @ 13,4% and you’ll have repaid back $39,781 in debt in 11 years time. Now we’re talking.

Every $1000 the car’s worth will also save you another $1000 in 10 – 11 years.

Repay all your debt until you reach debt with an interest rate below 4% and think

Once you reach debt with 4% or lower interest rate, you should’ve reached your mortgage or a low interest student loan from the government. I repaid my $25,000 student loan in about 3 years. That was my last (and only) high interest rate debt. It ran at 7,4%.

Now here’s where you start have to make choices again. Investing in Index funds should yield you a higher return than 4%. Calculated over a 20 year time period they should yield you about 5%. If you have your own company and you make more money on your equity than 4% you could invest the newly freed up cash in your own company.

My choice would be to keep paying off your debt first. All of it. Even if the interest is really low.

Pay off all your debt

We had a mortgage at a 4% rate. We recently refinanced to 2,84%. That’s a pretty good deal considering we get 50% of the interest we pay back here in The Netherlands. We paid back over $52,000 of debt in the last 6 years we’ve been living there now. If we just repaid the bare minimum, we would’ve repaid a total of $35,000. The extra 17k we paid off could’ve lowered our monthly bill with about $150, every month. Think about what you could spend 150 bucks on every month!! We didn’t want the extra spending money. We’re now actually paying off our mortgage 4 years sooner than we normally would BY NOT DOING A THING. We’re living pretty frugal and we knew that we didn’t need the extra 150 bucks. We wouldn’t miss it and spending it wouldn’t improve our happiness level. But being off a mortgage 4 years earlier is definitely something that WILL make us happier.

Own the right car for your daily needs, not your once a year needs

Like I mentioned before: owning a car is really expensive. Owning a car you don’t really need is CRAZY expensive. Lots of people have cars they don’t really need. They are to big (higher taxes and insurance rates). They are too new (higher insurance rates and higher depreciation). They are too old (lots of expenses + high fuel consumption). Etc. Etc.

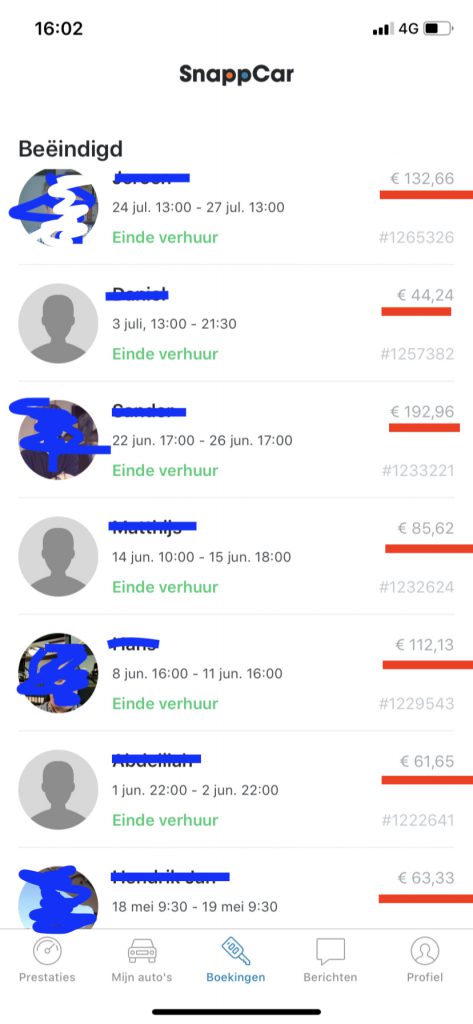

We own 2 cars. We only need 1. So I’m actually not living by my own norms, but I have a good reason for it. 1 of our cars is an asset. It actually makes us money. Just like you can rent out your room or house through AirBnB so too can you rent out you car. That car costs my $200 dollars a month. Pretty expensive. It’s a diesel so that costs a bit more in road tax. I use it when I need to travel far. I don’t use it a lot so I have lots of possibilities to rent it out.

In the past two months alone I earned 700 Euro’s by renting out that 1 car. It cost me 400. I made 300 bucks just by owning one. I don’t know if there’s a local SnappCar version in your country. But if you can find one, I’d register your car.

Just renting your car out for 2 days a month should pay for at least 50% of your fixed car costs.

All the money I earn through renting out is saved to a separate savings account. That savings account is to buy a new(ish) car in a few years time when this one is written off. I expect this car, it’s a 2008 BMW 3-series Diesel by the way, to still last at least 3 years. I service it myself (a great way to save a low of money) and do all the necessary maintenance on time.

In the future I’ll make a guide how to service your car yourself. Even for people who have never done anything on their car (not even refilling the windscreen wash) it’s still possible to save money by doing things that are SUPER EASY yourself.

Back to owning the right car. A lot of people own a car that they want all year but only need once or twice a year. There’s money to be made if you’re one of those guys (it’s usually guys really). Need a big truck because you have to move a lot stuff? When was the last time you actually did? If you do it less than 4 times a year, you don’t need that F150 truck. You can buy a normal (small) family car and save hundreds of bucks on insurance and tax and even more on fuel if you drive a lot. Rent the car for your special needs. A truck, a holiday car. It’s less expensive than owning one of these all year round.

If you own a car that’s 20 years old or older and you have a lot of expenses, you should really get rid of it. Yes I know, it’s you baby. You can’t say bye bye. But YOU NEED TO. It’s costing you too much money. There’s another reason why you shouldn’t use a 20 year old car. Fuel efficiency has greatly improved over the past decade. What you spend on a newer car, you’ll get back with a lower fuel bill.

Buy a car that’s at least 7 years old

7 year old cars or a bit older are probably the best “aged”. They’ve depreciated a lot but are still modern. You can buy $5000 – $10000 cars which are fine for small families (maximum of 2 or 3 children).

Buying a new(ish) car is hard. You should invest most time here, because this is when you actually make money. Never buy in a rush. Always come back a second time. ALWAYS bring an expert who knows a lot about cars and who can do the negotiating. Everyone knows a guy who knows a guy who knows a sh*tload about cars. Call him in. Bring him along for the ride. You can probably barter your way out with him. Maybe there’s something you can do for him that will get him to do you a favour with the car buying part. If you have to, pay someone (familiar).

The two most important things you have to consider when buying a new car are: fuel economy and fuel economy. 3rd is weight and 4th is space. You have to know how many miles you’re planning on driving a year. Use this excel sheet to calculate the different cars you’re comparing.

[insert car cost calculator sheet here]

If you drive a lot of miles > 20,000 a year fuel consumption becomes even more important. If you drive less the combination of weight and fuel consumption are both important. Mileage and weight are usually pretty correlated. Same goes for insurance cost + road tax and weight / fuel consumption. The less miles you make, the more important the fixed costs (road tax + insurance). The more miles you make the more important fuel consumption becomes.

Newer cars cost less in maintenance but the total cost of ownership is lot higher

A new car or even a car that’s less than 5 years old has still a lot to depreciate. A new $20,000 car will lose about half its value in the first 5 – 7 years. So besides insurance (which is higher because you want to insure against theft etc.) you pay 10,000 bucks just for owning the car. Most people buy new cars because they don’t want any trouble with the car. But if you bring the expert with you on your car hunt, you’ll have only a very very small chance that you’ve bought a piece of junk.

If you can, don’t own a car at all

Besides owning a house, a car is the most expensive thing you’ll ever buy. And while a house is usually an asset (you make money owning it in stead of losing money) a car is almost in all cases a liability. It costs money to own and operate. A lot. On average I’d say owning a car will set you back $2000 – $4000 a year. If you drive a really small one, don’t drive a lot of miles. Do the maintenance yourself, you could get as low as $1500 but that’s hard to do.

If you have any chance of not owning a car I would suggest and sell you car. Setting aside $2000 a year for the next 20 years will give you a total amount of 50,000 bucks! So the compounded interest alone (at 4%) will give you an extra 10k that can go towards earlier retiring.

Don’t switch your car for a cab please

In stead switch your car for a bike. I don’t know if where you live is a good place to bike, but it will sure save you a lot of bucks and is a nicer workout than sweating like a pig in the gym which sets you back at least 50 bucks a month.

I do most of my miles biking. I probably bike at least 3,000 miles per year by bike. I only take a car when the cost of the car is lower than public transportation and the time it takes me to take the car is a lot shorter than public transportation.

Live nearby your work

The easiest way to save money on driving cost is to live nearby your work. I work from home and from a nearby co-working spot. I even work inside our local church. It wasn’t being used for service anymore and has been completely repurposed as a library, a co-working space, a cafe and a museum. I wear noise canceling ear phones from Sony I only hear my music and absolutely no other noise in here.

If you drive 20,000 miles a year you are:

- wasting a lot of time commuting

- spending a lot of money on gas and maintenance

Think of it this way. Most people don’t care if their commute is 45 minutes one way. They think it’s not that bad. But that’s 1.5 hours per day. Or 7,5 hours per week! you’re actually working 6 days a week if you’re commuting for 45 minutes or more everyday. I also try to pick clients where my commute is below 30 minutes and who accept flexible working hours. That way I can avoid traffic jams so my travel time is more predictable.

How much money could you EARN in that extra day’s work? In stead, you are now WASTING that time behind in your car. You’re putting yourself at risk. Putting pressure on the environment and SPENDING money, in stead of making it, on gas.

In less that 10 years time you’ll have worked an extra YEAR for commuting over 45 minutes. If you didn’t spend the money on travel but on repaying your mortgage you could’ve saved over 100,000 bucks. That’s 10k a year for living closer.

Think about all the time you can spend at home doing the things that you love. Doing the things that give you energy and actually make you happy. Or the amount of money you could’ve earned if you didn’t commute but spent that time working. Even working half the time you saved on commuting would net me a total extra turnover of 160 hours x 85 dollars = 13,6k. That’s on top of the money you saved not travelling so much.

When I visit my clients I usually go by car. I have a couple of different clients per year and never know where I’ll end up next. So I bought the BMW 3-series with the thought in mind that I would rent it out if I didn’t use it at least 5 days a week. It’s a private owned car. My company didn’t pay for it because in the end I pay a lot more income tax for it. My company is now actually paying me for the use of my car. I charge my company 19 cents per km (or 30.4 cents per .62 mile).

I travel about 13,000 miles per year with it for company appointments, so my company incurs an extra 3952 dollars of cost. That saves me 1800 dollars of income tax because those costs lower my profit.

My per Mile cost for the car is:

- 11,2 cents gas

- 4,2 cents for insurance

- 11,3 cents for road tax

- 2 cents for maintenance

- Total cost per mile: 28,7 cents

I receive 30,4 cents per mile, it costs my 28,7 cents per mile. I actually make money every time I drive to a customer. For every 17 miles I drive to clients I can drive 1 mile for free for private appointments or holidays.

But remember: I already paid for all the insurance, road tax and maintenance cost. The total cost I make per year on those 3 items is calculated in the total mileage cost for the miles I make travelling to clients. So every mile I drive for private appointments only costs me 11,2 cents. That’s only 40% of the total cost of running the car. So in stead of having a free mile every 17 “company car” miles. I get 1,4 free miles every 17 company car miles. That’s 1070 free miles every year.

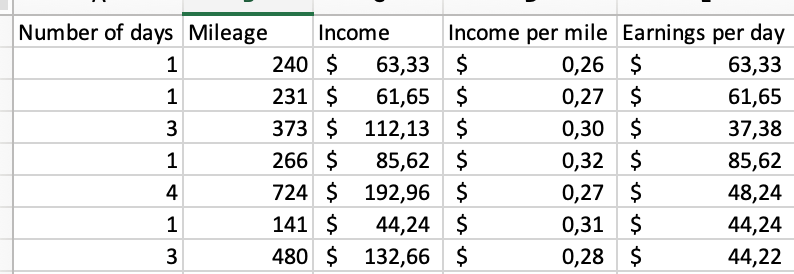

I calculate my per Mileage cost based on my Mileage. Like I mentioned before, I rent out my car. I get paid about 30 dollars per day when I rent it out. Renting my car out pays me on average 300 dollars a month. So all my fixed costs are covered by renting the car out.

300 dollars per month is nice, but you should calculate your cars’ cost per mile. So I have an Excel sheet were I fill in all the money I made with the car and how many miles people drove with it. Because the more they drive, the more maintenance cost I have.

My earnings per mile are around 28 cents. I calculate 3 cents per mile for extra maintenance costs. People who rent your car are usually a little less forgiving for the car. They drive a bit faster, abuse it a bit more. So I take that sort of behaviour into account but increasing my maintenance cost by 50%. That leaves me with 25 cents per mile driven by my renters that is totally free money. I can do whatever I want with it.

I save all of it for 2 reasons. I have a second car. A hobby car. And hobbies are allowed to cost money. I still have days / weeks where I think I need to get rid of this car, but every time I see it and every time my girlfriend sees it, we decide to hold on to it.

A ’91 Mercedes-Benz 560 SEC. The most beautiful car in the world. 300 HP. Great seats. Coupe windows. Cruise control. Climate control. But the mileage. Oops the mileage. Let’s not start about that shall we? 🙂

Don’t borrow money to buy a car

If you don’t have the money to buy a car…. Don’t buy a car. Sounds simple right? How the hell do you think you’ll pay for the car once you own it if you don’t even have the money to buy one now that you don’t have one (read: aren’t even incurring the extra costs for the car??). You won’t. If you borrow money for a car you’ll sink deeper and deeper in the death debt swamp.

WOW but there’s a financing deal on right now. It only costs 1,5% to finance my new car. That’s nothing right? Wrong. It’s a lot. For 2 reasons.

The first being: if you can borrow money to buy something, do you buy a smaller or older car? Or do you buy a little bit more of an expensive ride because “you can afford it”. Probably, most definitely the latter.

Second reason: Most mortgages have an interest rate well above 1,5%. Most even above 3%. So borrowing money while on the cheap is still a worse deal than paying back your mortgage which has an interest rate of 3%. Cars are usually financed for 3 – 6 years. You pay for the full amount but after 5 years the car will have halved in value. More expensive cars drop more in value than cheaper cars. So borrowing money will hurt you many times over.

Don’t accept a company car / lease cars unless you’ve made the necessary calculations

I don’t know how it works in other countries, but here in The Netherlands if you drive a company car, you pay income tax for it. it’s a form of payment in kind and a lot of countries tax it. 50% of all new car registrations are for company cars. So it’s really popular.

In our country you pay anywhere between 4% and 22% for new cars and 35% for cars older than 15 years. The percentage is a percentage of the total retail price your company paid that’s added to your income.

So let’s say you have a 50,000 dollar car and have an electric car, 4% of the 50k is added to your income. That’s 2000 dollars a year. If you reach over 60k of income a year here, you pay 50% taxes. So this would cost you 1k a year.

The benefits CAN outweigh the cons though. That’s why you have to calculate if it’s interesting for you or not. It depends on the amount of miles you drive for your work. What alternative transportation benefit scheme there is and how many miles you travel for private means.

Let’s say you’re in sales. You drive 20,000 miles per year to travel to clients and to commute to work. On top of that you travel 10,000 miles per years for private means. Would it be more interesting to drive a company car or to own your own?

A normal travel allowance for people who are in sales is about 800 bucks a month. Some companies pay this amount as a salary if you decide to drive in your own car. Let’s take that as an example. 800 bucks gross is about 400 net.

Could it be more interesting to drive my own car or not?

Let’s bring back the costs per mile again. For 13,000 miles they were 28,7 cents. My costs for mileage don’t change. but the costs per mile for insurance and tax will drop because my mileage went up.

New cost per mile for 20,000 miles / year

- 11,2 cents gas

- 2,7 cents for insurance

- 7,3 cents for road tax

- 1,8 cents for maintenance

- Total cost per mile: 23 cents

I drive 20,000 miles a year so that’s 1667 miles per month. 1667 * 23 = 383 bucks. That would leave me with just 17 bucks to do the private driving. I planned on doing 10,000 of those miles. That would only cost me the gas again because all the other costs have already been paid for.

10,000 miles costs me $1120. Together with the $17 dollars a month I still have left from the $400 I started with It’s actually cheaper for me to drive my own car. $17*12 = $204. $1120 – $204 = $916. So I save $84 per year if I drive my own car. The only problem of course is… I have to account for the depreciation of my own car and the fact that I someday have to replace it. SO with that in mind, this changes the outcome.

I’ll develop an Excel sheet that will help you make this decision for you. Because if I’d only make 5,000 private miles a year, I could save $764 a year to buy a new car. That could be more than enough to pay for a new car.

How to save on groceries

The next big thing you can save money on is groceries. Planning and budgeting is everything here.

Rule number one: Only go shopping once a week

The more frequent you go shopping, the more money you’ll spend. Limit your visit to the grocery store to once a week. That should immediately shave 10% off what you spend right now.

If you visit the store more frequent, you’ll buy stuff that you don’t need. It means you’re only taking of today. Only thinking about now. You probably have a full fridge back home. NEVER go shopping when you’re hungry. You’ll buy way more… 🙂

Rule number two: make a list of what you’ll eat that week

I’m working on a spreadsheet that will help you plan and budget your meals. In a 4 person household, if you have a 600 dollar budget per month for groceries it means you can spend $1.65 on every meal per person. If you think that’s not a lot of money.. You are wrong.

This is our Spaghetti bolognese recipe:

- table spoon of olive oil (10 cent)

- 1 onion (20 cent)

- 2 cloves of garlic (10 cent)

- 1 pound minced meat (6 dollar)

- 5 fresh tomatoes (1.5 dollar)

- 1 courgette ( 70 cent)

- 1 can of tomato’s (50 cent)

- 1 can of tomato puree (10 cent)

- Spaghetti (50 cent)

- Total: $9,7 = $2,42 per person

But thats more than 1,65? YES! We eat twice from this… 🙂 So it actually only costs us $1,21 per person.

Rule number 3: have one day per week where you clear out all the leftovers.

If you have one day a week where you eat everything that’s left over you’ll save 1,65 x 4 x 3 = $19,8 per week. Or $1k a year! You could save it or spend a bit extra when you have (birthday) parties.

Being frugal is pretty cool really 🙂 Did you know we through out a SH*TLOAD of food every year? 100 pounds a year, easily. Some is still edible. The rest is because you bought too much.

Rule number 4: grow your own food

But, but, but. I’m not a farmer? I don’t even have a garden. I’ve never touched a plant… I … SSssssss.

Owning plants, especially herbs, is very easy. They just need light and water. If you have no garden you can keep them indoors. Same if you’re not in the right climate. but where is it still cold these days with all the climate change?

We love to put fresh herbs in out food. But fresh herbs cost a lot of money if you keep buying them in store. Even the ones in those glass containers, the grinded stuff is crazy expensive. Everything you can grow yourself will save you a lot of money.

Easiest thing to do is to buy a basil plant or coriander plant at your local grocery store. In stead of plucking it empty immediately, plant it in a bigger pot so it has room to grow. I bought 3 pots of mint, basil, coriander and rosemary. They are now supplying our household with full time delicious herbs. Only cut the leaves of the basil. Don’t cut the branches. They’ll grow new leaves.

If you don’t have the climate for it, or only half the year, do still keep you plants outside. They grow a lot faster and maybe even more important: they taste better. Once the season start to come to and end harvest your herbs and put them in the freezer. You can keep them in there for months. In the meantime just place your pots indoors behind the window again and wait for them to grow again. Rinse and repeat. Saves us at least $1500 a year.

I try to plant some tomatoes, courgette and pepper plants as well. This gives us a bit of extra (free) food. If your fresh veggies turn bad. Don’t throw them away. In stead, cut them open. You’ll see that the seeds inside will have started growing. Gently take them out of the veggie (this works for tomatoes, peppers, courgette, etc. And place them in a pot with soil and add plenty of water. You can get a whole army of plants just from one rotting veggie!

Rule number 5: don’t eat out

Yes, in some cities it’s actually cheaper to order in or eat somewhere at a restaurant. But for everyone who isn’t living in New York city, it’s cheaper to drive to a big grocery food chain and buy your food and make it yourself.

Rule number 6: the budget and plan

If you walked through the entire article word for word, you should’ve gone through your entire year of bank statements. You should know how much you spend on groceries right now. If you don’t, check last month or a month that comes the closest to what you normally spend on groceries. What’s your magic number?

I’m in the process of creating a spreadsheet that will help you with your food spending. But more importantly that will help you get them under control and show you how much you can save by cutting down on food spending. Once the Spreadsheet is finished I’ll make it available to download.

To get your spending under control you need to know what you’re cooking. Because if you know what you’re eating you know what to buy. It’s a killer for your budget if you just walk in the store and have no clue what’s for dinner. You’ll grab the quick and easy stuff. You won’t buy things in bulk you often use. In short: you’ll spend a lot more money.

For a family of 4 it’s doable to go down to as low as $500 or less per month on food spending. We’re trying to get to $600 right now. We actually co own a farm (with 200 others) and we spend $80 on that every month. We don’t get full value from it as you would if you’d go to the store but it’s healthier, it’s local and tastes better. So we don’t mind to spend a bit more on that.

Most families of 4 are upwards of $1000 dollars a month. If you can bring down your spending in the $500 – $600 range you’ll save $61,133 in 10 years time. That’s quite a bit of money.

While I’m still working on my spreadsheet.. Grab your own. Or even a piece of paper will be enough for now. We do grocery shopping on Monday and make our list on Saturday or Sunday. On Saturday we visit our farm so we know exactly what we have for the week.

Based on our food we picked up from the farm we try to make 3 to 4 meals. We have to add meat or other veggies to them to get a full meal usually. So we need another 3 to 4 meals + extra’s before we’re done with our list.

For you it should be a bit simpler. You need breakfast and dinner probably 7 days a week. Depending on work / kids etc. you also need lunch 7 times a week. To make it easy we’ll just say that you have 21 meals to supply yourself with.

We usually eat the same in the morning. Bread. That’s easy and also pretty cheap. A loaf of bread is $2,20 here. It has on average 24 slices. So that’s 10 cent per slice. We average out on about 20 cents per spread. We sometimes use peanut butter, cheese, “spreadable” cheese, vegetarian sausage, etc.

Our children average out at 2 slices. So that’s 2x 10 + 2x 20 = 60 cents per person. My girlfriend eats a bit more. 3 slices on avg. So 90 cents. My breakfast is really expensive compared to theirs… :-/ I’m trying to lose a bit of wait so I’m avoiding bread and other high carb food. My breakfast runs me $2 a day IF I buy in bulk when it’s on sale. If I don’t buy in bulk I pay $3.50. I eat this stuff 6 days a week so thats 312 days a year. I can save, just with breakfast alone, $468 if I buy the stuff when it’s on sale. This is why you should plan. Normally I can buy this somewhere on sale every 4 weeks. So I need 24 of these. The best before date is very long. So I could actually buy 100 of them and they still would be good enough to eat.

Last tip which works well for me. The $1.65 is a great anchor point if you’re on the road a lot. Almost anything you buy will be more expensive that that. You’ll never get a proper meal. So prepare your meals at home. I mix some couscous with mint and lime. Add some tomatoes, cucumbers and chicken and have a great lunch for a little over $2. That’s a lot more value compared to a $1.50 Cheeseburger.

Just by having a budget and a plan, you can save 10% – 30% on groceries every month

It’s all about knowing what to buy when and in what quantities. Veggies and fruit will last you a week. So buying them in bulk doesn’t really help you out. Unless you freeze everything. You can make some great smoothies by freezing bananas, mangos and red fruit like strawberries and blue berries.

Another chunk of change can be saved when you buy in bulk. You need to get your per serving food cost down. 3 for 2 when you’ve already planned on eating 3 is great value. 3 for 2 when you’ve not even planned one in your meal plan is a bad deal.

Same with coupons. Coupons are excellent to save money, but they should have already been incorporated in your meal plan. If they’re not, getting 50% off something you’ve only going to use for 20% is still a shitty deal.

The third reason why you’ll save a lot of money is because you won’t buy stuff (or buy less) of the things that are not on your list. Going unprepared into the jaws of the grocery store will kill you financially. Some very smart people work there who’re trying to have you put as much in your basket as possible.

Some easy tweaks to lower your gas & electricity bill

The avg electricity & gas bill in the US is about $2400 a year. In The Netherlands it’s a little bit lower. About $2000 even though we pay roughly double the amount per kW and 30% more for our gas. Why?

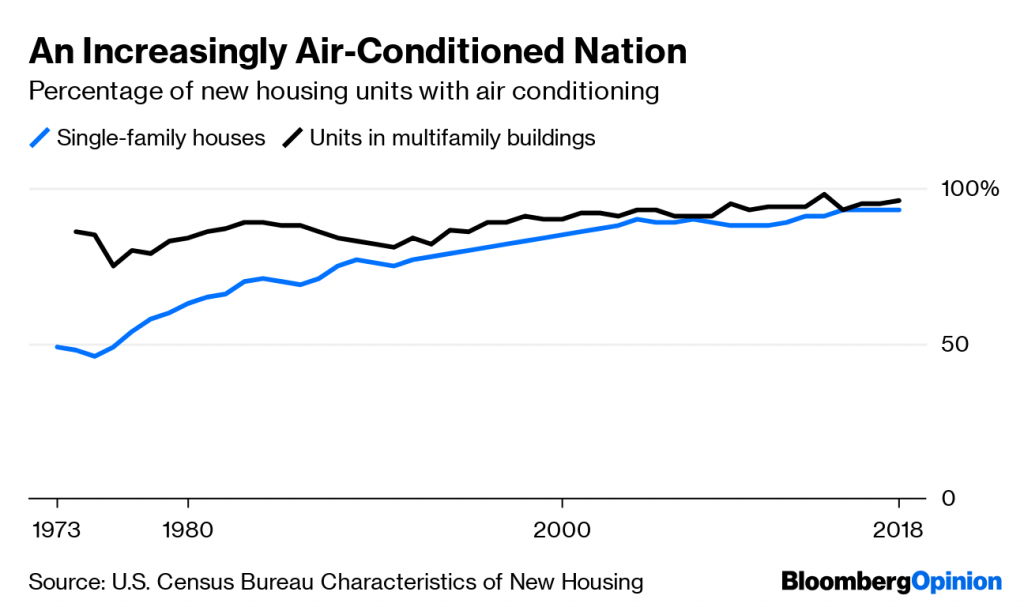

90% of your homes have air conditioning. More than anywhere in the world. And air conditioning costs a lot of money.

Even increasing your A/C temperate with 1 degree will save you about $100 on your electricity bill a year. Open up your house when temperatures start to drop so the house can also cool down. Once the temperature outside almost reaches the indoor temperature, close doors, windows and curtains. This will keep the maximum amount of heat outside.

It works the same way in the winter. Lowering your thermostat by just 1 degree will save you $100 a year, every year. If you do both (you A/C and your heating) you’ll save $2233 in 10 years time. If you wear a sweater in winter you can probably do without a few more degrees.

Heat reflective foil is your best friend in winter

Buy this stuff in spring because demand will be lower. You’ll have all summer to postpone doing the work and save 20% on your heating bill. What is it? Heat reflective foil is nothing more than a very thin layer of foil you line your attic with and stick on the wall behind your heating / radiators.

It is incredibly effective for the amount of money it costs. 30% of the heat that comes out of you radiator is absorbed by the wall behind it. Up to 50% of your heat just flies out of the attic if you don’t insulate it.

So using the foil will lower the amount of heat your radiators have to give for your room to become nice and warm. There’s another little tip you can use. If you have curtains who hang in front of the radiators, try to push them behind the radiators. That directs more heat inside your living space as opposed to against the windows.

Final tip on saving on your heating bill only works if you have some real large heat dispersing units. Place a (small) ventilator on top of them on the slowest setting. This will disperse the heat more to where you’re sitting in stead of keeping it close to the radiator or other “heat giving units”.

If you own a house, try to keep it in the “asset” box

When I was 16 I read the book “Rich Dad, Poor Dad“. It was my first personal finance book. I absolutely loved. From that moment on I started buying and creating assets. And buying more personal finance books.

What are assets I hear you ask? They make you money. An interest bearing savings account. A 401k. Stock. A house (if you’re smart). Owning assets should bring in money without the work.

A lot of people own a house but by the way they’re “treating” it push it toward the liabilities box. Liabilities are things that cost money. Your car is probably your biggest liability. You have to pay insurance and road tax even if you don’t use it. The car depreciates in value. It sucks the money from your account like a big vacuum cleaner.

This shouldn’t be the same with a house you own. Lets take a typical $250,000 house. Let’s say you have a $200,000 mortgage at 3%. On average houses appreciate in value at a rate of 4% per year. Inflation is around 2% a year. So your house gains a net value of 2% every year. That’s $5,000 a year without having to work. Pretty sweet.

Now consider these 2 families. Family 1 is repaying the house in 20 years with a linear mortgage. Their monthly payment $1109. It consists of $500 of interest and $609 for paying off the mortgage completely.

Family 2 has an interest-only mortgage. For the sake of argument they’ll have the same interest rate as family 1. Usually though, because you’re not lowering your mortgage with monthly payment but only paying for the interest, the bank’s risk is higher. A higher risk normally means a higher interest rate. Their monthly payment is only $500. Think of what you can do with those 600 bucks you don’t have to spend on your house!! WRONG!!!

This is the situation after 2 years. Family 1 will own a home that’s worth $371,487. When they sell it they will have 371k in their hands. They can use if for retirement, spend on their childrens’ education.

Family 2 will own the same house worth 371k but they still have the mortgage of 200k. If they sell it they’ll only have 171k for their retirement. A 200k difference! But that’s not the entire story. The best part (at least I think so) is that family is free from the chains of the bank. They have no more monthly payments to make to the bank. They now freed up 1100 bucks that can go somewhere else.

Family 2 will still have to pay their monthly payment of $500 dollars until they die. If you just follow through on a few tips in this FIRE guide you will have freed up at least 600 bucks a month to spend on repayment of your mortgage. If there’s absolutely no way you can make monthly payment to repay your mortgage… YOU SHOULD MOVE to a smaller house!

Remember: once you retire your income will drop significantly. So the extra 500 bucks that you don’t have to spend on rent / interest will be a life saver. Some banks even force you to sell your house if you haven’t completely repaid it (and can’t repay it) after you stop working. Because of your lower income, you won’t clear for the mortgage anymore. Foreclosure might be just around the corner. That’s not a situation you want to be in.

So back to the asset part of this story. Because the above example was just to show you what a difference it makes to repay your house in stead of just paying interest…

Because of appreciation you’re actually gaining wealth every year. In this example $5000 a year. But you spend $6000 a year on interest (3% of 200k). So this house isn’t really making you money. You spend more on it than it makes you. In the country where I live I actually get 50% of the interest I paid back through my income tax. Don’t know how that works for you.

If you can, you should pay off more of the principe mortgage. If you can repay another 34k of your mortgage you’ll find the point where you’ll be making money with your house in stead of spending more money on interest than that you gain through appreciation.

Why you should repay your mortgage quicker

How much is $1000 dollars in 20 years time? Quite a lot of cash if you have a 3% mortgage. If you repay an extra $1000 you will have actually repaid $1806 in 20 years time. You almost doubled your money. So just for the sake of not being a moron you should repay your mortgage quicker if you can.

We repay our mortgage quicker than needed too. We’re both entrepreneurs so our income fluctuates a lot. Every time we have enough money to last us a couple of months we look at where it’s best to invest in. Our mortgage rate dropped to 2.84% and we get 50% back via our income tax so we only have a 1.42% interest rate. Investing in Index Funds via our 401k will give us a better return than repaying the mortgage back quicker. But being mortgage free is also something great to have. So sometimes we pay a bit extra for our mortgage. Sometimes we invest some more in our retirement.

Get a roommate or rent your place out

True true, this isn’t for everyone. If you have a family, children, a sick mother living with you… You won’t be able to do this. But if you’re still in your twenties and you’re living alone you are losing a lot of money. You can save 33% – 66% on your rental if you can find a roommate or 2 to come live with you. Depending on where you live and how expensive rent is, you could be making an extra $300 – $2000 a month. How long would it take you to get a raise like that? 2 to 6 years? You might even have to change jobs to get a pay rise of 2k a month. It’s such easy money.

An alternative is to put your crib on AirBnB. Little more hassle but more Dinero my friend. Definitely so if you do your own cleaning.

Earn money with renting out your extra (closet) space

There’s actually a website which lets you connect with people that are not like you or not in the habit of becoming you. Meaning: they still own too much crap. They spend too much money on things they don’t need. They even continue doing this after they outgrow their house.

If you live in the US Neighbor just started. You can rent out your space. They are growing fast and you should be able to rent out your spare space if you price it right.

If you live in the UK use Stashbee. They’re the biggest one in the UK.

The spare space you aren’t renting out yet can always be used to store your grocery items who’re on sale. There are a few things I eat I could buy 100 pieces of them. I eat about 250 a year and there best before date is usually more than a year in the future. So that gives me a lot of possibilities to save money when they’re on sale.

Lose the subscriptions

How much are you spending on subscriptions every month? How many subscriptions do you even have? Check your credit card statement now! And find out how much it is.

The easiest subscriptions to cancel are the ones you don’t use. I’ll bet you there is at least one subscription you’re not using which you could cancel right now. Don’t think twice about it. Cancel it immediately.

I canceled my gym subscription a long time ago. In stead I bought myself a racing bike, inline skates and a small gym rack for pull ups and stuff. Total cost: $500. The gym rack was $30 dollars. The inline skates where about $70. I paid about $400 for the bike. That’s my new gym. In 1 year I earned back my gym membership fee. Every year after that, which has been over 6 years now, I earned $500. $3000 dollars in 6 years just from making a simple change.

If you go to the gym because of the company… Call a friend and ask him/her to go with you on a bike ride. To share the gym you made at home. Anything better than being sucked into the subscription based economy.

Don’t get me wrong, I think some subscription are great. Especially when they don’t have to buy 50 cd’s year but can listen to everything you want for $10. But when the cost of the subscription is so much higher than what you can organise yourself and still have quite a decent level of satisfaction…. You should buy stuff in stead of subscribing to something.

Back to the subscriptions. There’s a subscription for everything these days. Books. Music. Video. Money. Anything can be subscribed to. A rule of thumb I use is to have less than 3% of your disposable income goto subscriptions.

One way to get this down is to NOT BUY A $1000 MOBILE PHONE via a subscription. You’ll pay extra for the fact that you didn’t buy that thing with your own money. The phone company also locks you in longer at worse rates than if you already owned a mobile phone. If you’re someone who did this, chances are you’re already above the 3% limit. Next time your contract is up for renewal. Keep your phone. Don’t buy a new one. Get a better deal.

Do NOT hire someone to clean up your own sh*t

A cleaning lady. Someone who folds the laundry for you. Does the lawn. There’s someone for everything. If you want to save some real dough you should do more stuff yourself.

Every end of summer starts an inevitable caravan of contractors in the neighbourhood. They bring huge machines. They make a lot of noise. Waste a lot of precious oil products. And most important: they eat away your money. All for clearing leaves and mowing the lawn.

Did you know there’s an apparatus so powerful it will clear thousands of square feet per hour? It’s called a human with a rake and a hand lawnmower. You don’t need machines. You don’t need engines. You just need you hands. Add a bit of sweat. Subtract a bit of fat. Tadaaa. A tidied up garden. Same goes for all the other stuff I mentioned.

Mister Money Moustache calls this “Muscle over Motors”. Probably everything you do in and around the house (except drilling holes) you can do with just your body and a tool that doesn’t rely on gas to be powered.

There’s one example to this rule though. When your lack of knowledge actually saves you money.

If you’re not an accountant, don’t do your own tax return. It takes them less time and you should get more value than what you paid for. I’ve been an entrepreneur now for more than 12 years. In the first 8 of those I let an accountant do my tax returns. In those 8 years I learned a lot about our local tax system and was able to gain more value by doing it myself. I could get the same amount of tax returned but I didn’t have to pay a fee for filing and doing me bookkeeping. I did it all myself.

Same goes for when you need a lawyer. Don’t think you can manage yourself. If in doubt, contact a friendly attorney, someone you know who you can ask for some advice. Usually when shit hits the fan you should lawyer up and be well prepared.

The easiest way to start investing

If you followed all the tips above, you should have freed up at least 1k a month and if you were really spending like crazy, thousands of dollars a month. But where to put all that money? You can always give it to me of course… 🙂 But if you really want to become financially independent you gave to invest.

Invest…? You mean with stocks and bonds and ups and downs? Yes! With all that. Because in the end, you just earn more return on your money than putting it “safely” on an interest bearing bank account where you get 1% interest.

If you live in the US, probably the easiest way to start investing (besides putting money in your 401k) is a service like Betterment. You give them your money. They manage it. You earn a return. You can use Betterment for all kinds of goals.

If you don’t live in the US / don’t live in a place where your currency is the $$$ don’t use them. Because you’re investing in Dollars and your local currency could fluctuate too much for it to be worthwhile. You’ll be adding an extra uncertainty which you shouldn’t when you’re investing (for retirement).

Betterment is a so-called robo-investor. They have machines doing the work for you. There’s nu fund manager who needs to get paid. No one who’s trying to steer you towards a certain fund based on commission they receive. It’s just a machine that does nothing more than look at numbers all day long.

Betterment is fully tuned to the American market and tax system. They have auto Tax Loss Harvesting. Tax saving if you have a standard and retirement account.

If they don’t have a similar service like this in your country, buy Index funds.

You have a couple of different type of stocks you can buy. Bonds issued by governments or companies. Normal stock. Stock funds (they have an expensive Fund Manager which has to be paid and that costs a lot of money) and Index Funds. Index funds are your best bet if you want to start investing. If you’re worth millions only then is it a smart move to start investing in stock. This is why:

Index Funds track a basket of stocks. It could be the S&P 500 of the Dow Jones. But at least hundreds of different stocks from different companies. Every so often a company fall over. If you have that stock in your portfolio, you lose big time. If you own an index fund and one of the stocks in that fund goes boom, you lose less than 1%.

The most popular Index Funds I invest in are:

- Vanguard FTSE All World

- Vanguard Global Momentum

- iShares Core MSCI World UCITS

- iShares S&P 500

As long as you still have 20 years or more to go you can go all out on Index Funds.

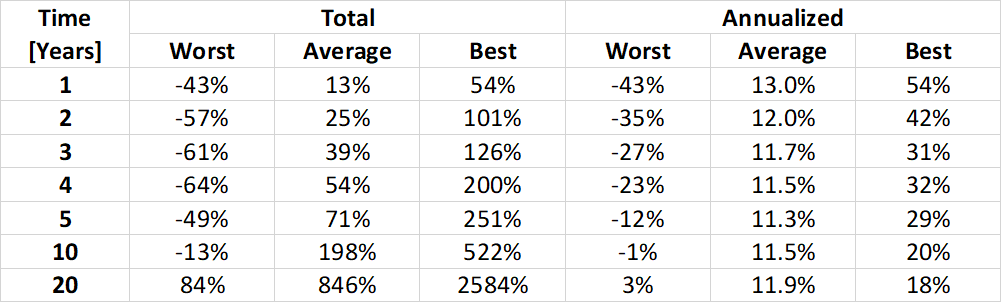

This is a table which shows you, before inflation, how much return you’d make on investing in US stock. This is the annualized gains / losses from the US stock market for the past like 100 years. In the most extreme scenario you’d still be up 3%. More likely would be about 11.9% per year or 846% total return.

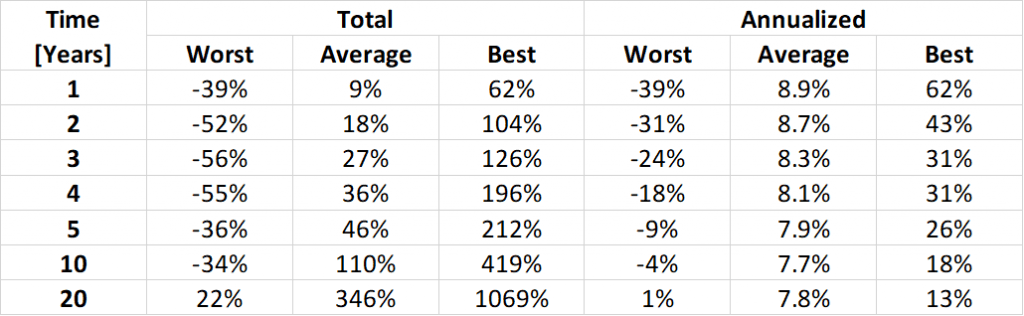

The below table shows you the same numbers but with inflation taken into account. So this money has the same value as is has now. You can still buy the same bread for the same money.

So in the absolute extremely unlikely scenario you will still make a gain of 1% per year after 20 years.

If you put your money in a savings account, you’ll barely (usually not even) get more interest than inflation. So you’ll be in the “worst” bracket after 20 years. Meaning you’ll have made a total return of 22%. While with investing chances are pretty decent that you’ll make a total return of 346%.

Let’s see what 10k compounds to in 20 years @ 1% (savings account AT BEST) or at 7.8% (investment account on average).

10k in your savings account would net you $12,202 in 20 years time. 10k in your investment account would net you $44,913. That’s almost 4 times the amount you would get via saving. I don’t have to tell you what 100k or even 1M looks like after 20 years. Just add a few zeros. The only difference is the absolute difference between the amount when you save and the amount when you invest.

32k when investing 10k

320k when investing 100k

3,2M when investing 1M

Once retirement closes in on you, and you are still a long way from retiring you should not be investing all your money in stocks. Meaning: you haven’t yet made your money pile big enough to live off but your moment of retiring is coming closer, than you should pull out a bit from just investing in stocks. In general they have a higher rate of return, but they are also riskier. You don’t want to lose 10% of your life savings in the few years before retiring. You want to slowly divest in stocks and put some more cash in bonds which have a lower risk (and lower return).

But how much do I need to put into retirement?

That’s easy man! 100% of your income. If you are able to put everything you earn into retirement, you basically already are… But that would be too easy… Or too hard?

As a basic rule you have to have an invested a sum of 25x your yearly spending. So if you spend 50k a years you need… 1.25M. With 1.25M you can live off the 4% interest.

So you have 2 factors here at play. Your savings rate and your yearly living expenses. The more you save the earlier you can retire. The more you can limit your yearly spending, though the less you need to retire.

For every Dollar you can save on spending you don’t need to invest 25 Dollars in retirement. Plus that Dollar you just saved you can put towards retirement and retire even earlier. Lowering your spending is THE MOST POWERFUL trick in the FIRE (Financial Independence, Retire Early) Book.

If you can live off of 20k a year, you only need 500k. If you make 50k a year and save 50% of your income you can retire in 17 years!

What should my savings rate be if I want to retire early?

| Savings rate | Years to retirement |

| 5% | 66 years |

| 10% | 51 years |

| 15% | 43 years |

| 20% | 37 years |

| 25% | 32 years |

| 30% | 28 years |

| 35% | 25 years |

| 40% | 22 years |

| 45% | 19 years |

| 50% | 17 years |

| 75% | 7 years |

| 90% | less than 3 years |

This table isn’t completely accurate. Because if you save 90% of 30k for 3 years you’ll have about 81k. But you would only be able to live off that if you have a yearly spending of 3,2k or less. When you still have a mortgage, young children, etc. You can probably not do that… If you CAN manage to get your spending down to below 3k for the remainder of your life, then of course it’s no problem.

For you young guns who don’t want to work all day nor for the same boss for 10 years, read this

How much do you spend on Starbucks? On takeaway? On not cooking for yourself or going out in general? By just stopping your spending for these few things, you can probably easily free up 20% if not 30% of your take home (net) pay. If you were already saving 10% a year, you can retire within 28 years. If you’re really spending a sh*tload of money on ordering food right now you could probably retire before you reach the age of 50. Get a roommate for 5 more years? Retire before you’re 40! That means only changing jobs a couple of times. And only working for 1/3 of your life. Who wouldn’t want that?

You (if you’re in your twenties) are in the best spot to begin retirement early. You still have options. You probably don’t own a house, don’t have children and live at home with your parents… You could be saving 80% of your income with ease right now.

Every time you get a pay rise you should do this with it

DON’T SPEND IT. Those 100 bucks a month aren’t worth it on spending it on extra things. What do you really get out of it happiness wise? Probably nothing? But if you invest 100 bucks for 20 years you’ll end up with 36,722 Dollars extra for your retirement. That will make your life 1500 bucks easier every year just in interest alone. Think about what you can do with a 1k pay rise. You could retire 15 years earlier probably.

Don’t fall for the “my peers have that too” syndrome. Or I want an almost as big car as my boss. This lifestyle inflation is deadly for your early retirement dreams. If you can be Zen about it. If you can stay frugal, this is when you can make big gains towards your goal of early retirement.